A report in the Wall Street Journal from May 8th, 2020 claims that Elon Musk funds his personal lifestyle by taking out loans with Tesla stock as the collateral. Certainly, he is not the only wealthy individual who wants to hold on to his stocks but still have cash for the finer things in life. And with the Tesla stock going through the roof these days this must be excellent collateral and everybody must be happy, right?

Well, this may be so but as a lender you have to keep an eye on the price of these stocks. If the market goes south your collateral will quickly lose value and you may need to ask for more stocks or some other collateral. These are the highly ominous margin calls known from the famous Wallstreet movie. Between banks margin calls can be a complicated affair with exposure calculations, master agreements, haircuts, etc. but here we have a simple case. The exposure is fixed, the relationships are clear and the only thing that varies is the price of the stock. In this kind of setting it is easy to reduce everything to just monitoring the price of the stock used for the collateral. A breach of a certain threshold triggers the margin call.

To monitor this you need to monitor the constant stream of prices coming from the market. Front Arena already has a price feed running so the data is there. One can program a script listening for prices and build a service running it all the time but if there is a standard solution that can be utilized I would prefer this. For a similar problem we already have Barrier Monitoring scripts in Prime. One can easily install an ATS-Service and start running them. This is an easy setup without much configuration needed. FCA 2799 describes the steps to install an ATS and the entry script can be (depending on the type of monitoring) FSEQBarrierMonitorPrice.

With the ATS running we turn to setting up the monitoring of a particular stock. This should be done by normal Prime users that don’t have superuser access or programming knowledge. With these constraints the solution is to use dummy barrier options with the collateral stock as underlying. These options will be monitored by the ATS and the barrier will be knocked out when the threshold is breached.

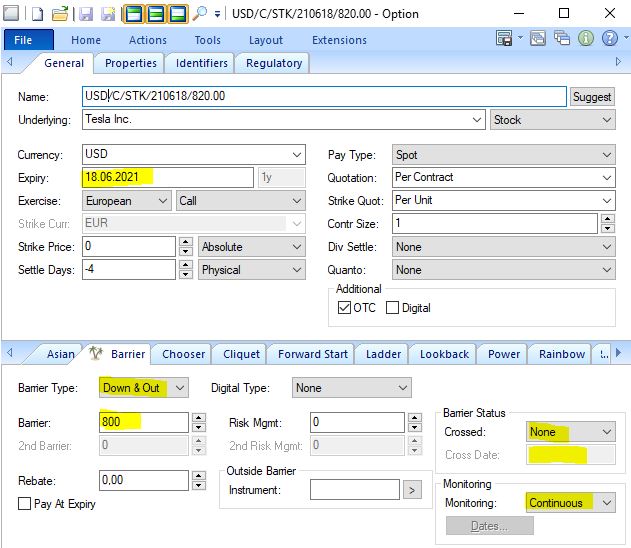

Bellow is an example of a dummy option set up on the Tesla stock. The barrier is the price threshold that we have determined. For the type of barrier option we choose “Down & Out” – not that it really matters as this option will never be exercised. It is important to set the monitoring to “Continuous” to monitor the price all the time. Since we will be monitoring the stock as long as the credit is running the option expiry date will be the date that the credit is supposed to be paid back (or rolled over). The rest of the fields don’t really matter and we leave them with their defaults.

If there are multiple threshold that should trigger different margin calls then we set up multiple such options with different barriers.

With these dummy barrier options and the ATS running in the background we already have the continuous price monitoring needed. When the price crosses a threshold the ATS would change the Barrier Status to “Crossed” and record the Cross Date. Saving this is an update on the instrument which can be used with the FValidation hook to trigger further actions. For example if different people have to be alerted about the breach and not all of them have access to Prime, a Python function can be used to send emails to these recipients. Writing such a function in Python is straightforward and it can be reused for other purposes.

If the list of email recipients is not fixed and has to be managed somehow in Prime then a Front Arena Party (preferably “Internal Dept”) can be set up to hold the contacts for these emails. This Party can be linked to some or all of the barrier options.

With this solution you have an efficient method of implementing monitoring and margin calls. It uses standard functionality and scripts and once it has been implemented can be left to regular users in the Back Office and Risk divisions to manage.